As you must have noticed, every decision that we make and every option we choose is a calculated risk we take. It plays an important role in the domain of risk analysis. On a daily basis, you might come across several small and big choices that affect our lives in ways you cannot comprehend. You face ambiguity and uncertainty regularly. And although you might have all the necessary information and data, it is not humanly possible to use it to accurately interpret the future. That’s when the Monte Carlo Simulation, otherwise known as the Monte Carlo Method, comes into the picture. Moreover, you can also call it the Multiple Probability Simulation.

What this method basically does is that it enables you to view all the plausible results of the decision you make while assessing the risk’s impact. In turn, this helps you make a better and well-informed decision causing minimal risks. In this article, you will learn in-depth about Monte Carlo Simulation. Further, you will also get a brief idea about the history of this method. Then, you will come across the entire working process that is involved in this method along with the various probability distributions. In the end, you will understand and comprehend this concept better with the help of an example.

What is Monte Carlo Simulation?

Table of Contents

At the risk of sounding very robotic and technical, let us start by understanding this term. Monte Carlo Simulation is a mathematical technique or method that allows you to perform quantitative analysis and make decisions by accounting in all the risks. Professionals use this method in a wide range of industries including engineering, finance, oil and gas, manufacturing, insurance, research and development, transportation, and more.

It presents you with a variety of all the possible results along with their probability of occurrence based on your decisions and actions. It furnishes all the possibilities and the results for both conservative and broke decisions you make. Besides, it also shows the results and consequences of the middle-ground decisions that you opt for.

This method is generally used in order to model probabilities of various outcomes in a process especially if you are unable to easily predict it because of the interference of random variables. The main use of this model is to get an insight into the uncertainty and risk impact while working on prediction models.

Now, let’s take a dive into the history and origin of this complex method.

History of Monte Carlo Simulation Explained

Scientists developed and used the Monte Carlo Simulation in the 1940s while working on the atomic bomb. They named this method after Monaco, a city famous for its games of chance and casinos. The main aim is to make use of random samples of inputs and parameters to understand complex processes and systems along with their behavior.

While working on the atomic bomb, scientists were facing several issues based on physics including neutron diffusion models. It was not easy for these scientists to provide an analytical solution for such complex problems which is why they evaluated them numerically. Although they had access to MANIAC, one of the oldest computers, their models included several dimensions making the numerical evaluation process slow.

To everyone’s surprise, this method proved to be extremely effective in coming up with solutions for these issues. Ever since then, experts and researchers have been applying this technique to a versatile range of problems. They have been using this technique to model both conceptual and physical systems since World War II. Now, you will learn how this method works and what are the various processes involved in it.

Working of Monte Carlo Method

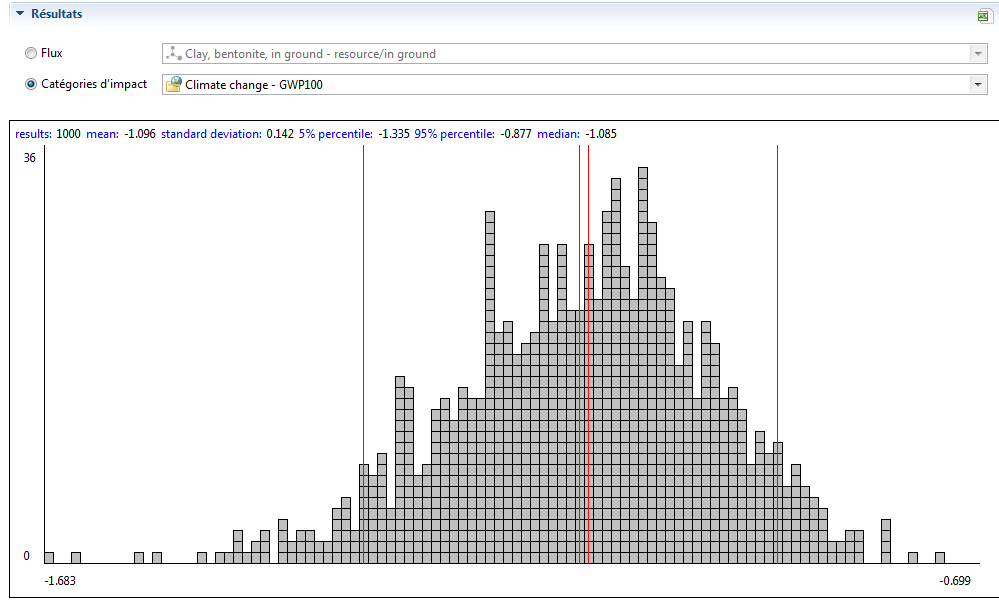

Monte Carlo Method performs analysis of risks by developing models of all possible outcomes. They do this by substituting several values (performing probability distribution) for the uncertain parameters. Further, this process calculates the outcomes repeatedly while using different values every time. Based on the count of uncertainties along with their specific range, this simulation may involve several recalculations before completion. Monte Carlo Simulation offers a varied range of outcomes in a distributed form.

With the help of probability distribution, the probabilities for the occurrence of distinct results may differ. This process of the probability distribution is way more realistic in use in terms of risk analysis as compared to any other method. The following are some of the most popular Probability Distributions.

Normal Distribution

You can also refer to this distribution as the “Bell Curve”. In this, the users need to define the expected mean value along with the standard deviation. This helps in describing the mean variation. The values in the center part of the distribution, near the mean value, are the ones that are likely to occur. This distribution is symmetrical allowing you to describe and process several natural phenomena. Examples of this type of distribution include variables such as energy prices and inflation rates.

Lognormal Distribution

Unlike the case of the normal distribution, this includes distorted values rather than symmetrical ones. It represents the values having limitless positive potential and are more than zero. Examples include stock prices, property values of real estate, oil reserves, etc.

Uniform Distribution

In the case of Uniform Distribution, there is an equal chance for all the values to occur. You just need to define the minimum value and the maximum value. This type of distribution includes various variable examples such as the revenue of future sales for new products, manufacturing costs, and more.

Triangular Distribution

In Triangular Distribution, you need to define all the necessary values – the minimum, the maximum, and the most likely, The values under most likely are the ones that have the most chances to occur. You can describe values like past sales data per time unit as well as inventory levels.

PERT Distribution

Similar to Triangular Distribution, in the case of PERT distribution also you need to define the minimum, maximum, and the most likely values. But, there are more chances of occurrence for the values that are there between most likely and extremes. Meaning, the extreme values are less emphasized. This distribution is generally used to define the task duration for models of project management.

Discrete Distribution

For this, you need to define the values that may occur specifically, along with each of their probability of occurrence. You can consider the example of a lawsuit result where there is a 10% chance for a mistrial, a 40% chance for settlement, 20% for the positive verdict while 30% for a negative one.

Monte Carlo Simulation Example

In this method, you need to isolate several key variables that are responsible for describing and controlling the result of this experiment. Once you process a large set of random variables or samples, you need to assign a probability distribution. One of the most popular examples of this method is rolling a dice. Here is how the game works:

- The player starts playing the game by rolling three dice with six sides thrice.

- If the calculation total of these three throws is either seven or eleven then they win.

- If the total is either in the range of 3-5 or 16-18 they lose.

- When their outcome is none of the ones mentioned above then, they need to roll the dice again

- When they re-roll the dice, this game works in the same way as earlier. However, they only win when their total is the same as the sum determined in the earlier round.

There are over 5,000 possibilities and results that you need to use in this process.

Monte Carlo Simulation Steps

The Steps to prepare the data using Monte Carlo Simulation are as follows:

Step 1: Event of Rolling the Dice

Build a data range comprising the outcomes of all the three die for about 50 rolls. In order to get started with this, you need to make use of the “RANDBETWEEN(1,6)” function. Then, every time you press the F9 key, you can generate a brand new result of the set of rolls. The “Outcome” column contains the sum total of the results of all three rolls.

Step 2: Result Range

Later, you need to build a data range in order to identify all the feasible results for the first as well as the succeeding rounds. It contains a data range of three columns such that, the first column includes all the numbers from 1-18. These numbers represent the results that follow after you roll the dice thrice. The findings for the first two cells comprising of values one and two respectively are nil as it is not possible to get these values with three dice. The minimum value that you can obtain is three.

The next column includes all the possible results after the first roll. As mentioned earlier, they either win, lose, or re-roll based on the conclusions of the earlier round.

The third and the last column registers the feasible outcomes to the subsequent rounds. You can get this with the help of the “IF” function. Further, this ensures whether the obtained outcome is the same as the one In the first round then the player wins. If not, then they need to follow the same process and rules stated before.

Step 3: Conclusion

In this step, you need to interpret the result of the 50 rolls of the dice. You can achieve the first result by using the index function. It will help you search for all the possible outcomes of the first round along with the corresponding result. If the player rolls a six then they have to re-roll the dice.

You can obtain the findings of all the dice rolls with the help of the “OR” function and a nested “IF” function. This, in turn, sends a message to Excel to stop rolling the in the case where the result earlier is Win or Lose. Else, you need to check the column of the conclusions and identify the actual result.

Step 4: Dice Rolls Count

The next step is to identify the count of rolls that are necessary before the player wins or loses. You can do this by using the “COUNTIF” function which needs Excel to count the outcomes of the re-rolls while adding one to it. You need to add one due to the extra round that helps in obtaining the final result.

Step 5: Simulation

This step requires you to build a range in order to keep a track of all the results of the distinct simulations. In order to do this, you need to start by creating three columns. The first column involves 5,000 as one of its figures while, in the second column, you need to search for the outcome after 50 rolls of the dice. In the third column, you need to search for the count of the number of times the player rolled the dice before they obtained the final result (either win or lose).

Later, you need to develop a sensitivity analysis table with the help of table data or feature data table. You need to insert this sensitivity in the other two columns, the second and the third. In this analysis, you need to insert the count of events from 1-5,000 in the A1 or any empty cell present in the file. The main aim is to basically force recalculation every time and further receive new rolls of the dice. This will lead to new simulations, without affecting the original Monte Carlo formula.

Step 6: Probability

In the final step of this process, you need to calculate the probabilities of both the outcomes – losing and winning. You can obtain this with the help of the “COUNTIF” function. This formula will help you keep a count of all the wins and losses and further, divide them by the total count of the events, that is, 5,000. This allows you to achieve the proportion of both the results as a ratio. In the end, you will notice that the chances of winning or the winning probability are 73.2% while the losing probability is 26.8%.

Final Thoughts

The Monte Carlo Simulation is a helpful tool to assess the outcomes of a decision and factor in the risk probability. Rather than manually trying to guess outcomes, you can use this for greater efficacy and reliability.